Phone: 08 9842 5155

End of Financial Year Preparation – Key Tips

The end of the financial year is fast approaching, and now is the time to do some homework to avoid the mad rush early in July.

Payroll

Since the inception of Single Touch Payroll (STP), employers are no longer required to issue payment summaries to their employees. This is all done through their STP payroll finalisation.

The Australian Tax Office (ATO) requires business owners to finalise payroll by 14 July. This doesn’t leave much time between the final pay run of the year and the 14th of July to find and fix any payroll errors. Importantly, any errors found after STP finalisation is lodged with the ATO are likely to cause big headaches for employees and employers as they are not simple fixes.

Key tip: It pays to review payroll on a monthly or quarterly basis so issues are easier to identify, but for most business owners, this doesn’t happen. However, now is a good time to do just that to ensure everything is good to go ahead of the lodgement deadline.

Key tip: For all new staff, make sure you have the correct superannuation details, have entered them into your payroll software, and are also the clearing house (if you use a clearing house).

Nothing is worse than entering all of your superannuation payments into a clearing house only to realise you have missed one employee’s details, which requires you to start over again.

Superannuation

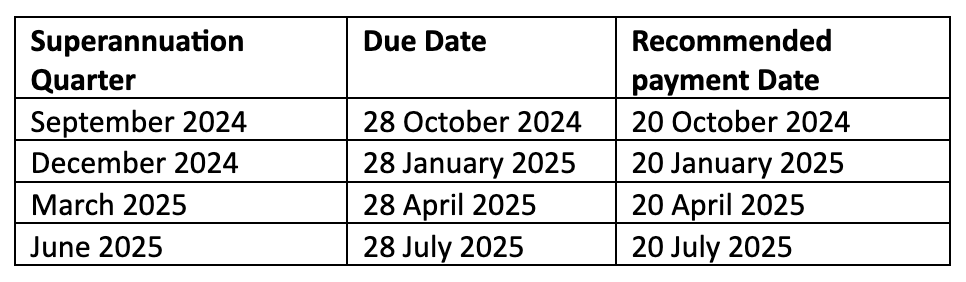

Superannuation contributions are due on the 28th of the month after the quarter ends. Additionally, the employee superannuation guarantee increases to 11.5% as of 1 July 2024 for any wage payment made on or after this date.

Key tip: Just a reminder, even though the ATO advise that superannuation contributions are due on the 28th of the month after the quarter ends, what they mean is the payments must be in the employee's superannuation fund by the 28th. So, in order to ensure that the payment is received into the fund on or before the 28th, it is recommended that you lodge and pay by the 20th of the month after the quarter ends. The ATO is imposing harsh penalties on employers who don’t make the contributions on time. Any late contributions cannot be claimed as a deduction.

Key tip:

If your payroll ends on 30 June but you don’t pay until 1 July, you will need to pay the 11.5%. All cloud-based programs should automatically update the rate, but you should still check to make sure it is updated, and if you are running old software, you will need to make the change manually.

Taxable Payments Annual Report (TPAR)

The TPAR is an industry-specific report for businesses that need to report the total payments they have made to contractors for services. This report is due to the ATO by 28 August 2024, and the information that needs to be provided is as follows:

- Contractor Name and Address

- ABN of contractor

- Value of services rendered

Services that come under the Taxable payments annual reporting System are:

- Building and construction

- Cleaning

- Courier and road freight

- Information technology (IT)

- Security, investigation or surveillance

Key tip: Now would be a good time to review your records to ensure you have all the necessary information about your contractors up to date. For new contractors, you should always check that their ABN is correct and that they are registered for GST.

Reconciling

It is also now the time for business owners to check their bank and clearing accounts. This includes:

- Reconciling all bank accounts to physical bank statements (ideally, this should be done monthly).

- Checking clearing accounts are back to zero and if not, determine why not.

- Checking that all suspense accounts are back to zero. If not, each transaction should be narrated so the accountant knows why those transactions are sitting there.

- Checking that wages and superannuation amounts match your Profit and Loss.

- Checking that the superannuation payable, wages payable and PAYG amount all balance back to your Balance Sheet.

Key tip: If your file contains errors, these reconciliations should help you find them.

However, keep in mind that the Smith Thornton Bookkeeping team is here to support you and guide you in making the end of the financial year run smoothly.

MYOB, Xero Reckon, QuickBooks, Agrimaster, and Employment Hero all have tutorials on their websites for the end-of-financial-year processes. These tutorials are great resources for helping you understand what you need to do and how to do it.

Good luck with your end-of-year process. Again, we are only a phone call away if you need us.

Contact Us

Office Location

234 Stirling Tce

Albany, WA 6330

Australia

Postal Address

PO Box 5445

Albany, WA 6332

Australia

Secure Client Login

CPA Australia

Partner Logo Name

Partner Logo Name

We're proudly partnered with...

MYOB

MYOB

Xero

Xero

employsure

employsure